137 countries on board for OECD digital tax plan: Gurria

PTI, Jan 24, 2020, 3:21 PM IST

Davos: OECD chief Angela Gurria on Thursday said the international body’s plan to help solve digital tax problems has got the support of 137 countries and new rules must be put in place to stop evasion worth hundreds of billions of dollars.

Speaking here at a session during WEF 2020, he said the new plan is not about specific digital companies but is an issue for finance ministers finding their income going down.

“We need to establish new rules to avoid hundreds of billions of dollars not being paid in tax,” he said.

Some countries, including France, have postponed their own laws to give a multilateral solution a chance.

Most tax systems rely on companies having a physical presence in a country.

Gurria said he is confident that the OECD’s deal will be agreed upon, despite doubts expressed by some countries, including the US.

“Are we on track? Yes,” he said.

“We have been working on this digital tax plan for 2-3 years. In the second half of 2020, we will go for implementation. We believe it is possible to deliver this deal and gain the consensus we need. The small and medium-sized companies are captive in their borders and have to pay tax, where the biggest companies in the world pay 0.02 per cent,” Gurria said.

According to him, it is a question of trust and if people feel that they have to pay, and the rich don’t, they will eventually go out on the streets to complain.

OECD is the Organisation for Economic Cooperation and Development and is headquartered in Paris.

France’s Minister of Economy and Finance Bruno Le Maire said there is a loophole in the international tax system.

Companies in the digital economy are not paying their fair share of tax in the countries they operate, he said, adding, “we will not give up on this. Companies that owe France’s digital tax will pay”.

Noting that the French government is working with its counterparts in the US and with the OECD, Le Maire hoped that by the end of 2020, there would be an international agreement to tax digital revenues.

If an international agreement is not reached, he stressed that France will revert to its national solution, he added.

Udayavani is now on Telegram. Click here to join our channel and stay updated with the latest news.

Top News

Related Articles More

India not reaping benefits of democratic dividend: Raghuram Rajan

Markets slump for third day on fears of escalating tensions in Middle East; IT stocks drag

Tesla is planning to lay off 10 of its workers after dismal 1Q sales, multiple news outlets report

With just Rs 150 base airfare take a 50-minute flight

Byju’s founder Raveendran to take over firm’s daily operations after CEO Mohan’s resignation

MUST WATCH

Latest Additions

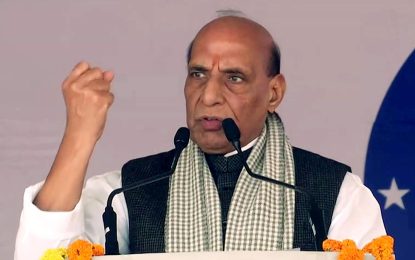

Rahul Gandhi lacks the bravery to run in the Amethi election, claims Rajnath Singh

Bangalore North: BJP leader Karandlaje being ‘controversial’ is plus for me: Cong’s Rajeev Gowda

IPL: Down with hip strain, RCB’s Maxwell unlikely to play against KKR on Sunday

Space will cast its influence on air, maritime and land domains: Chief of defence staff

ED attaches Rs 98 cr worth assets of actor Shilpa Shetty, husband Raj Kundra