Govt waives penalty for non-compliance with QR code provisions for B2C transactions

PTI, Nov 30, 2020, 4:21 PM IST

New Delhi: The government has waived the penalty for non-compliance with QR code provisions for B2C (business-to-consumer) invoices generated by businesses till March 31, 2021.

However, it would be mandatory for businesses to follow the QR code provisions from April 1, 2021, to avail this penalty waiver.

The requirement of printing dynamic QR code on B2C invoices is being implemented from December 1.

Quick Response code or QR code helps users verify the details in digitally signed e-invoices.

Under the Goods and Services Tax (GST), companies with a turnover of over Rs 500 crore have to generate e-invoices for B2B (business-to-business) transactions from October 1. However, it is not yet mandatory for B2C transactions.

The Central Board of Indirect Taxes and Customs (CBIC), in a November 29 notification, said the penalty has been waived for non-compliance with QR code provisions for B2C transactions between the period from December 1, 2020, to March 31, 2021, subject to the condition that the said person complies with the provisions from April 1, 2021.

Commenting on the step, EY Tax Partner Abhishek Jain said, “The central government has provided the much-required relaxation for the businesses by waiving the penalty for non-compliance with QR code requirement till March 2021 for B2C transactions. As many of the industry players were not ready, this waiver would give the requisite time for the industry to be ready for this compliance.”

AMRG & Associates Partner Rajat Mohan said, “Government has waived the penalty for non-compliance to QR code provisions if they are complied by April 1, 2021, for default during the period of December 1, 2020, to March 31, 2021. This will be a relief for large taxpayers who were unable to implement this digital change in the invoicing system due to the shortage of resources during the pandemic.”

Under e-invoicing, taxpayers have to generate invoices on their internal systems (ERP/accounting/billing software) and then report it online to the ”Invoice Registration Portal” (IRP).

The IRP will validate the information provided in the invoices and return the digitally signed e-invoices with a unique ”Invoice Reference Number” (IRN) along with a QR code to the taxpayer.

Udayavani is now on Telegram. Click here to join our channel and stay updated with the latest news.

Top News

Related Articles More

Govt to come out with detailed guidelines for electric vehicle policy

Interim stay on order suspending manufacture of 14 Patanjali drugs: Official

GSTN rolls out special procedure for tobacco manufacturers to register machines with tax authorities

Last chance to apply for UG and PG Programs at MAHE Bengaluru

UN revises India’s 2024 economic growth projection upwards to nearly 7%

MUST WATCH

Latest Additions

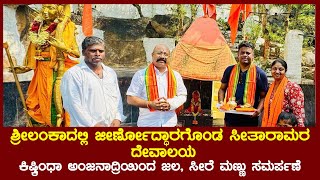

SC bids adieu to Justice A S Bopanna after tenure of 5 years

Brutal heat scorches northwest India, Delhi’s Najafgarh warmest in country at 47.4 degrees Celsius

SC reserves verdict on Kejriwal’s plea against arrest, allows him to move trial court for bail

AAP has given in under a ‘goon’s pressure’, now questioning my character: Swati Maliwal

Kerala Govt seeks compensation for man’s death in Oman amid Air India Express strike