CCD crisis: private equity players and independent directors under sebi scanner

PTI, Jul 31, 2019, 9:37 AM IST

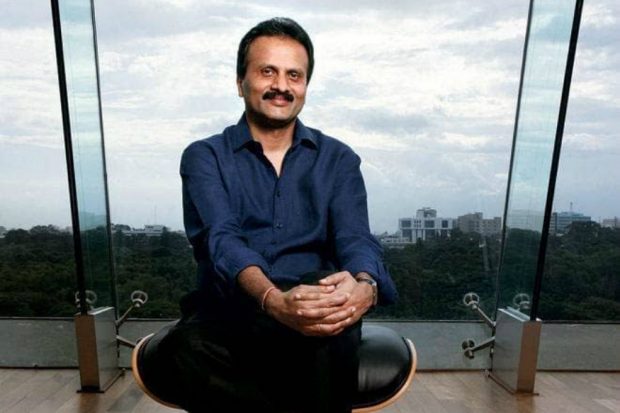

New Delhi: Role of some private equity players and their nominees on Coffee Day Enterprises, as also some independent directors, has come under the scanner of markets regulator Sebi in the wake of a crisis at the leading coffee chain operator due to disappearance of its founder and chief V G Siddhartha.

Sources said the regulator is also looking at trading pattern in the company shares and the disclosures made by the company to check any lapses.

There are concerns that private equity players do not make sufficient disclosures about their investment pacts and the same is also not disclosed by the respective companies which receive such funds, officials said.

Siddhartha went missing on his way to Mangalore from Bengaluru on Monday evening, prompting the authorities to launch a massive search on Tuesday.

Days before his disappearance, Siddhartha on July 27 in a letter to the company board and employees had said he was under pressure from one of the private equity partners to buy back shares.

Global buyout major KKR, which holds around 6 per cent in Coffee Day Enterprises currently, said it is “deeply saddened” by the disappearance of Siddhartha.

KKR mentioned that it had invested in the popular coffee chain nine years ago and part-exited the investment last year.

Siddhartha in the letter has also alleged that that there was a lot of harassment from the previous DG Income Tax in the form of attaching “our shares on two separate occasions to block our Mindtree deal and then taking position of our Coffee Day shares, although revised returns have been filed by us”.

After the news of Siddhartha’s disappearance broke, eminent business leader Kiran Mazumdar Shaw tweeted, “It seems to indicate that the Private Equity fund manager acted like a money lender and seems to have caused unbearable stress – needs to be investigated”.

Shares of Coffee Day Enterprises Ltd dropped 20 per cent on Tuesday, eroding Rs 813 crore from its market valuation, after reports surfaced that its Chairman and Managing Director V G Siddhartha has gone missing.

The scrip tumbled 19.99 per cent to Rs 154.05 — its 52-week low as well as its lower circuit limit — on the BSE.

On the National Stock Exchange (NSE), shares plummeted 20 per cent to its lowest trading permissible limit for the day as also its one-year low of Rs 153.40 apiece.

Led by the massive drop in its share price, the company’s market valuation dived Rs 812.67 crore to Rs 3,254.33 crore on the BSE.

Udayavani is now on Telegram. Click here to join our channel and stay updated with the latest news.

Top News

Related Articles More

Sensex, Nifty edge up in restricted trade ahead of US inflation data

Sensex, Nifty edge up in choppy trade amid caution ahead of US inflation data

ADB lowers India’s GDP growth forecast to 6.5 pc for FY25

M.B. Patil strengthens Karnataka-France business ties for Invest Karnataka 2025

SEBI bans finfluencer, firm from securities mkt; orders Rs 9.5 cr disgorgement for unlawful advisory biz

MUST WATCH

Latest Additions

K’taka CM flays ‘One Nation, One Election’ Bill as attack on democracy and states’ rights

Karnataka reports 641 digital fraud cases in 2024, losses exceed Rs 109 cr

Kejriwal writes to EC, hopes action to address threat of mass deletion of votes

Ayodhya: First anniversary of consecration ceremony at Ram temple to be held on Jan 11

State cannot suffer violation of right to clean environment on any pretext: NGT

Thanks for visiting Udayavani

You seem to have an Ad Blocker on.

To continue reading, please turn it off or whitelist Udayavani.